How investors use GRESB

GRESB is the global sustainability benchmark for real assets, used by investors to understand and measure the performance of funds and assets against the most material non-financial metrics. With GRESB you can:

- Simplify ESG data gathering and validation

- Engage with managers on risks and opportunities

- Integrate sustainability data into your investment decision-making

- Analyze the environmental footprint of your portfolio

- Prepare for financial risks and emerging regulations

Make the most of your portfolio insights

As a GRESB Investor Member, you gain access to unparalleled sustainability data and analytics of real estate and infrastructure funds and assets as well as a suite of tools for unique business intelligence.

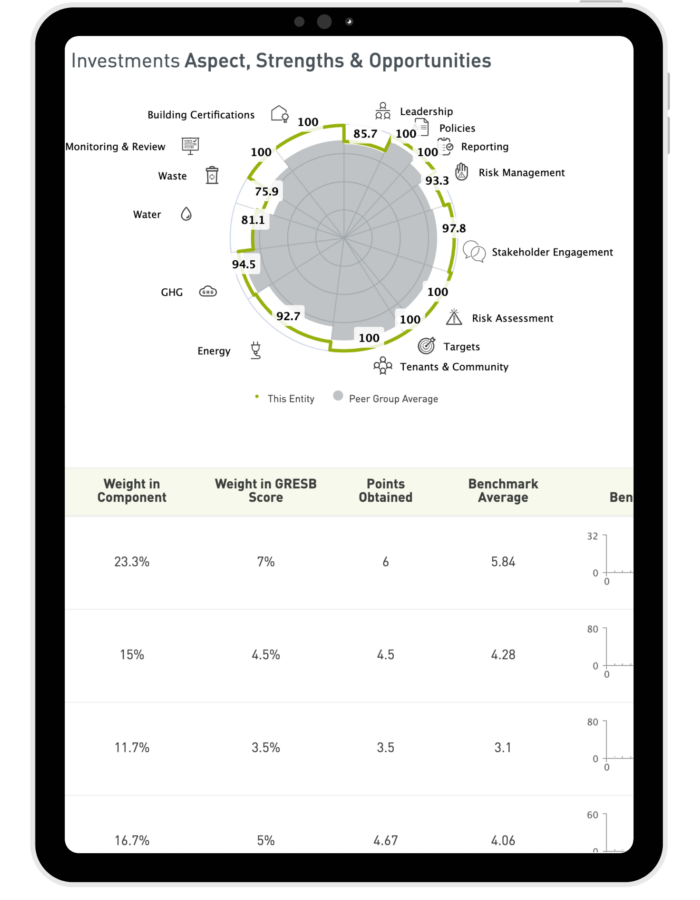

Gain a deep understanding of the non-financial performance of individual investments and their relative strength compared to peers.

Identify areas of risk and opportunity in your portfolio – and engage more productively with your managers on sustainability issues.

Apply specific parameters and weights to create customized benchmarks to see your portfolio’s relative performance based on the characteristics of your choice.

Calculate the environmental footprint and improve your stakeholder engagement.

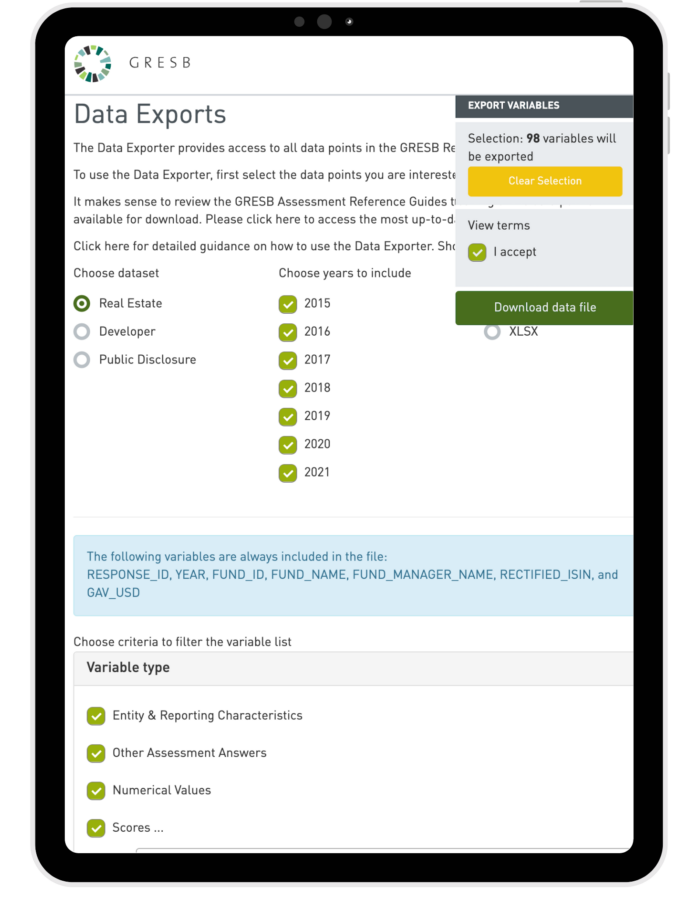

Leverage your GRESB data by exporting the full set of variables for custom analysis or inclusion in your existing portfolio management systems.

Datasets are available for download in .csv and .xlsx formats.

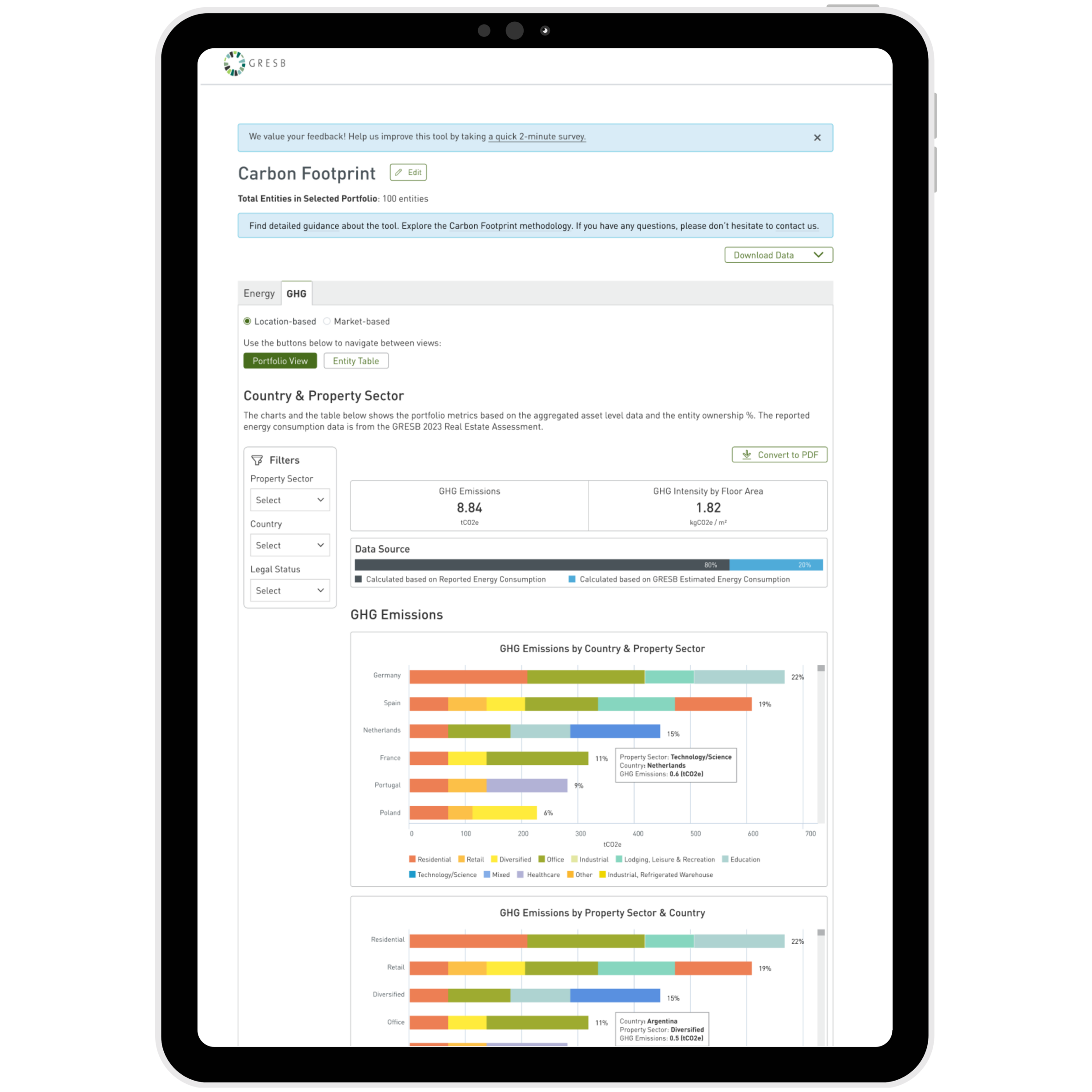

Carbon Footprint Dashboard

Better understand the energy consumption and greenhouse gas emissions of your GRESB real estate portfolio. Get an overview of your portfolio’s environmental impact and uncover insights to inform decision-making – benefiting both investments and the planet.

Investors, managers and GRESB

As an industry-led organization, GRESB designed its reports and tools to make structured engagement between investors and asset managers as productive as possible. Managers and asset operators self-report sustainability-related data in a standardized format to the GRESB Portal, where it is validated, scored and benchmarked against industry peers. Investors can request access to the entities within their portfolios as well as any other GRESB Participant. This relationship provides a consistent, globally recognized framework to measure and act on material, non-financial performance data. Learn more about how GRESB works.

By the industry, for the industry

Established by small group of investors in 2009, GRESB is now used by 150 institutional and financial investors to monitor investments, engage with managers and make informed decisions.

Today, the portfolios of more than 2,200 real estate companies, REITs, funds and developers – and more than 800 infrastructure funds and asset operators – participate in GRESB Assessments. This broad market coverage provides investors with ESG data and benchmarks for USD 9 trillion worth of assets under management.

Getting started

GRESB offers subscriptions to four ESG datasets: Non-listed Real Estate, Listed Real Estate, Non-Listed Infrastructure and Listed Infrastructure. As a mission-driven and industry-led organization, we are committed to keeping subscription fees low.

Already a GRESB Investor Member?

You can find key dates and important resources – related to the GRESB Portal as well as engaging with managers and increasing their ESG coverage – on our guidance page for investors.

Learn more about becoming a GRESB Investor Member

"*" indicates required fields